All You Need to Know About BASEL III Norms

The Basel committee on Banking Supervision (BCBS) was formed in 1974 by a group of central bank governors of G-10 countries. Later on the committee was expanded to include members from nearly 30 countries. BCBS in 1988 released Basel-I accords and subsequently to overcome the loopholes in it Basel–II was released in 2004.

BCBS released a comprehensive reform package in Dec 2010, which is called as Basel–III, a global regulatory framework for more resilient banks and banking systems. These recommendations cover almost all the nations. And it amend the Basel-2 guidelines, also introduces some new concepts and recommendations.

The question now arises when we already have defined norms in place then what is the need for new norm? Let’s discuss it in detail.

Need For BASEL-3 Worldwide:

Banks mainly deals with three kind of risks. These are

1. Credit risk

2. Market risk

3. Operational risk

What is Credit risk?

It is basically the risk of loss, arising when a borrower is not capable of paying back the loan as promised. Such borrowers are also known as Sub-prime borrowers.

Now lets go back to the year 2008 ,when all of us observed /witnessed the Global financial crisis ,which originated in US because of these Subprime borrowers and this crisis thereafter spilled over in the other markets as well. It created financial crisis throughout the world.

Thus a need was felt for more stringent banking regulation worldwide.

Now In India what is the need to adopt such norms when we saw our banking system standing firm even during the crisis.

Need for Basel–III in INDIA

1. Firstly, The most important reason is that as India connects with the rest of the world, and as increasingly Indian banks go abroad and foreign banks come on to our shores, we cannot afford to have a regulatory deviation from global standards. Any deviation will hurt us.

2. Secondly, if we ought to maintain a low standard regulatory regime this will put Indian banks at a disadvantage in global competition.

Therefore, It is becomes important that Indian banks have the cushionprovided by this risk management system to withstand shocks from external systems, especially as we deepen our links with the global financial system.

In India, Basel III regulations has been implemented from April 1, 2013 in phases

and it will be fully implemented as on March 31, 2019.

The pillars of BASEL norms:

1. Capital adequacy requirements

2. Supervisory review

3. Market discipline

Recommendations of Basel–III

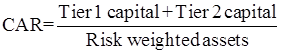

Firstly, Basel-3 recommended that the Capital Adequacy ratio (CAR) be increased to 8% internationally, while in INDIA it is 9%.

Capital Adequacy ratio(CAR), also known as

Capital to Risk (weighted) Assets Ratio (CRAR),

is a ratio of a bank’s capital to its risk.

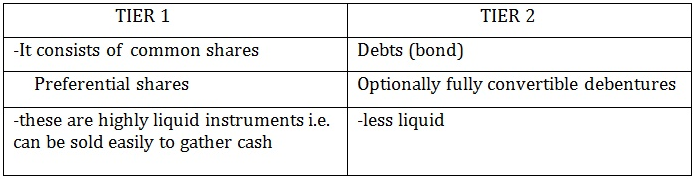

Capital is the money a bank receives in exchange for issuing shares. This capital is further classified into two – Tier 1 and Tier 2 capital.

Out of the 9% (of RWA) capital adequacy requirement, 7%(of RWA) has to be met by Tier 1 capital while the remaining 2%(of RWA) by Tier 2 capital.

Risk weighted assets- Every bank assigns its assets some weight-age based on the risk involved.Thus apply a weight percentage to each of its assets.

For example–

Lets say a bank lends Rs 100 to a person for home loan and Rs 100 to a person to start a new company.

Bank's total asset = Rs 100 + Rs 100 = Rs 200

Let's imagine home loan has high probability of being repaid than the loan to person to start a company.

i.e. Risk Weight of Home Loan = 50% and Risk Weight of loan for company = 90%

Risk Weighted Assets of Bank = 50% of 100 + 90% of 100 = 50 + 90 = Rs. 140. So out of total assets worth Rs. 200, Rs. 140 are risk weighted assets.

Bank need 9% of RWA as Capital.

Bank need 9% of 140 = Rs. 12.6 as Capital.

Means, out of Rs. 200 that a bank lends, Rs. 12.6 must be funded with Capital. Rest, Rs. 187.4 can be from the money that bank borrowed.

Secondly it also introduces the concept of leverage ratio, it measures the ratio of banks total assets to bank’s capital. Under the new set of guidelines, RBI has set the leverage ratio at 4.5% (3% under Basel III).

Leverage Ratio = Capital/Total Asset

Concept of leverage – for e.g.

If you have Rs. 100 and you invest them and earns a profit of 10% i.e. you have profit of Rs. 10 on Rs. 100. This is called non leverage profit.

Now again you have Rs. 100 and you borrow Rs. 400 and invest Rs. 500, earns a profit of 10% i.e. you earn Rs. 50 on your Rs. 100. This is called leverage profit.

With Higher leverage, Bank's Profit/Loss = Higher = Higher Risk also!

So now leverage ratio of 4.5% means for every Rs bank funds itself with, it can lend up to 22.22 Rs.

Challenges For It's Implementation In India

1. Capital- Since nearly 2.4 lakh crore rupees are required for its implementation in India.

2. Liquidity- During the global crisis 2008, the apparently strong banks of the world ran into difficulties when the inter bank wholesale funding market witnessed a seizure. Thus in Indian context, it would mean an additional burden of maintaining liquidity along with the SLR requirement.

3. Technology- BCBS is in the process of making significant changes in standard approach for computing RWAs for all three risk areas. Banks may need to upgrade their systems and processes to be able to compute capital requirements based on revised standard approach.

4. Skill development- Implementation of the new capital accord requires higher specialized skills in banks.

5. Governance- One can have the capital, the liquid assets and the infrastructure. But corporate governance will be the deciding factor in the ability of a bank to meet the challenges. Strong capital gives financial strength, it cannot assure good performance unless backed by good corporate governance.

Steps Taken by Government

(i) GOI has allowed banks to access markets to raise capital while maintaining a minimum 52% shareholding.

(ii) Govt. also launched a scheme called INDRADHANUSH to revamp PSBs. This scheme seeks to improve the efficiency and functioning of banks thereby reducing the bad assets. And also plans to infuse Rs 70,000 crore in the banking system over next 5 years.

In this regard government also announced two banks as DSIBs(Domestic Systemically Important Banks) i.e. SBI and ICICI, based on the criteria of size, interconnectedness, complexity and substitutability.

Note: According to new Basel-III norms, which kick in from March 2019,Indian banks need to maintain a minimum capital adequacy ratio (CAR) of 9 per cent (7 % for Tier I + 2% on Tier II Capital), in addition to a capital conservation buffer, which would be in the form of common equity at 2.5 per cent of the risk weighted assets